Arkansas Car Sales Tax Online

File online File online at the Arkansas Taxpayer Access Point ATAP. Sales tax registration and title fees.

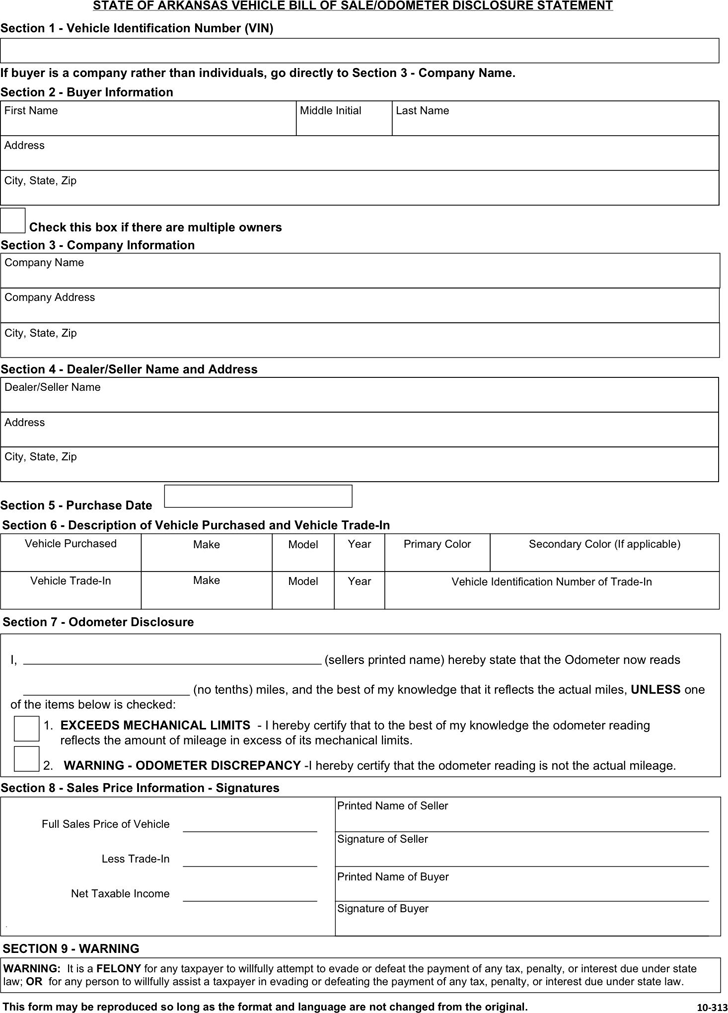

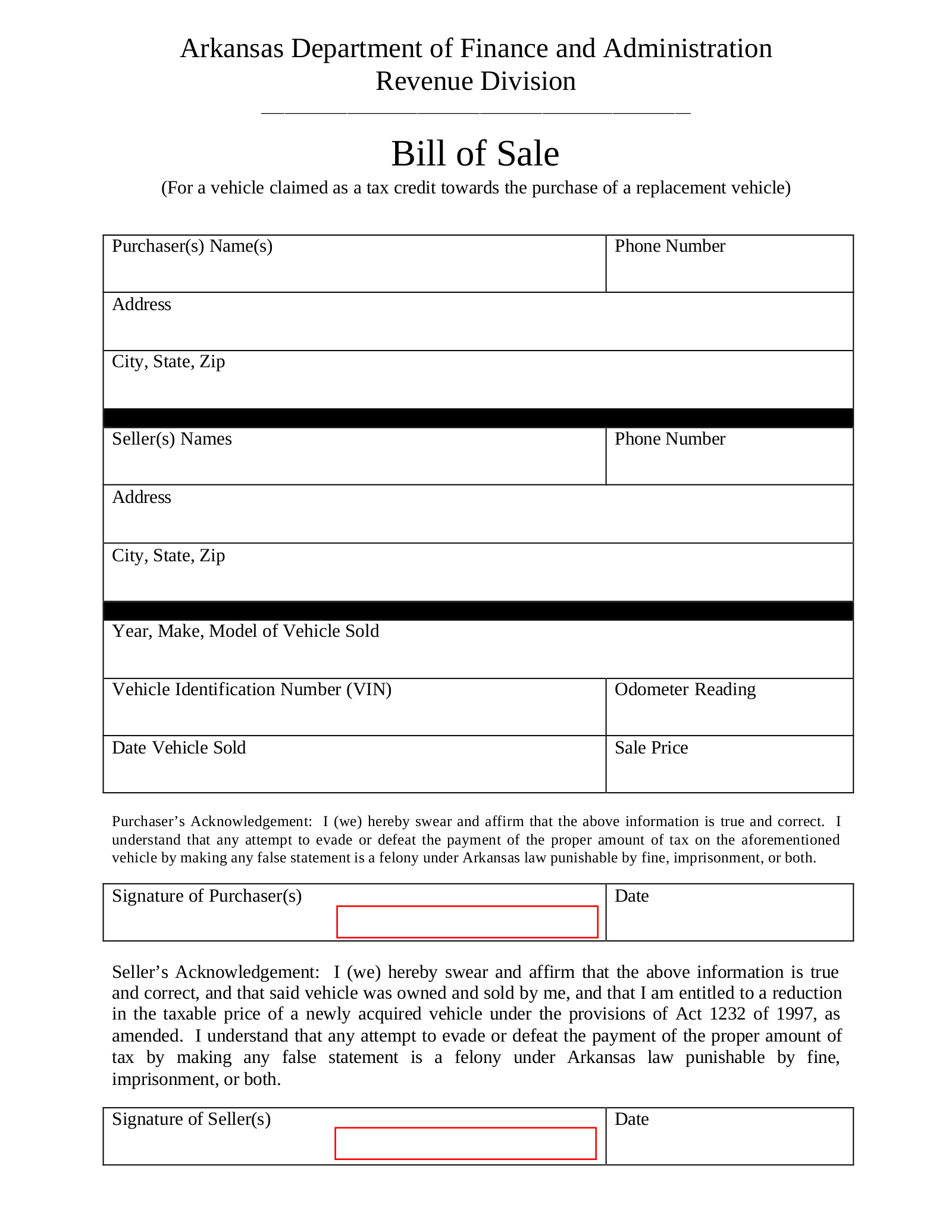

Free Arkansas Vehicle Bill Of Sale Form Pdf 926kb 1 Page S

Great article about our cause.

Arkansas car sales tax online. ATAP is a web-based service that allows taxpayers or their designated representative online. Administers the interpretation collection and enforcement of the Arkansas Sales and Use tax laws. Vehicles which were purchased at a cost of 4000 dollars or less are not applicable for state sales tax and will not be charged.

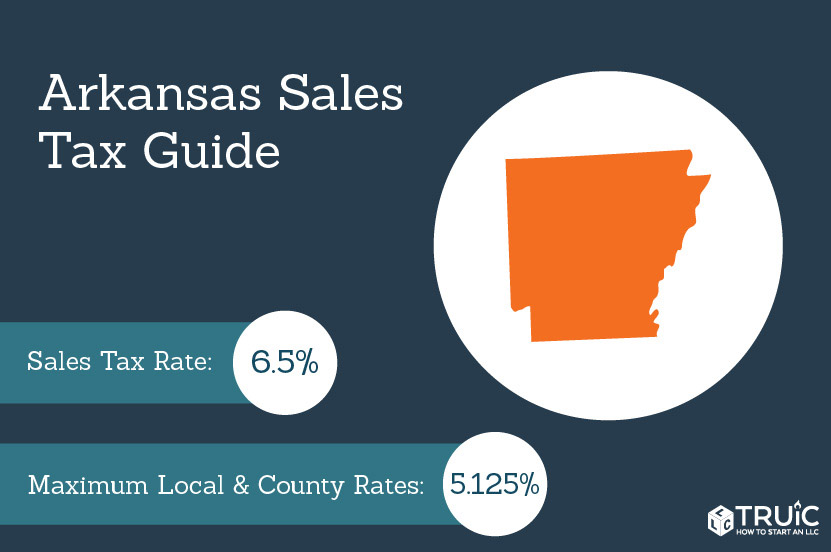

These online services will help you get behind the wheel and driving anywhere but the DMV. Pre-register Your New Vehicle. Arkansas has state sales tax of 65 and allows local governments to collect a local option sales tax of up to 55.

A new group has formed to give a bigger tax break to used car buyers in Arkansas and an outgoing state representative will help with the effort. This includes Sales Use Aviation Sales and Use Mixed Drink Liquor Excise Tourism Short Term Rental Vehicle Short Term Rental Residential Moving Beer Excise and City and County Local Option Sales and Use Taxes. Home Excise Tax Tax CreditsSpecial Refunds Sales Tax Credit for Sale of a Used Vehicle.

You have two options for filing and paying your Arkansas sales tax. To file this way you must contact the Arkansas Department of Finance and. Arkansas has a 65 statewide sales tax rate but also has 268 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2126.

Sales and Use Tax. You can remit your payment through their online system. Tax on Arkansas car washes leaves one owner scratching his head.

The state sales and use tax rate is 65 7 for Texarkana residents of the taxable price of motor vehicles trailers and semi-trailers with a gross purchase price of 400000 or greater. Home Excise Tax Sales and Use Tax Electronic Filing and Payment Options. Do that and apply for your title transfer your license plate and pay sales tax.

Bart Hester R-Cave Springs to the House for further consideration. Arkansans For Reduced Car Sales Tax. The state sales and use tax rate is 65 percent.

If you really want to pay your vehicle sales tax at the DMV you can streamline your visit by pre-registering here. The Senate voted 27-3 to send Senate Bill 576 by Sen. Asa Hutchinson center and Rep Charlie Collins R-Fayetteville right.

Youll get a confirmation code to take to the DMV. Electronic Filing and Payment Options. Act 822 is one of 32 new laws that went into effect on July 1 - a law that now requires remote retailers accommodations intermediaries and car washes to remit sales tax to the Arkansas.

Stated differently in order to qualif- y for the relevant sales tax credit the same person or entity must be the consumer who pays the sales tax on the purchase of a motor vehicle and the consumer who. Home Excise Tax Sales and Use Tax. REGISTER YOUR NEW VEHICLE If youre new to Arkansas or just bought a car youll need to get it registered within 30 days.

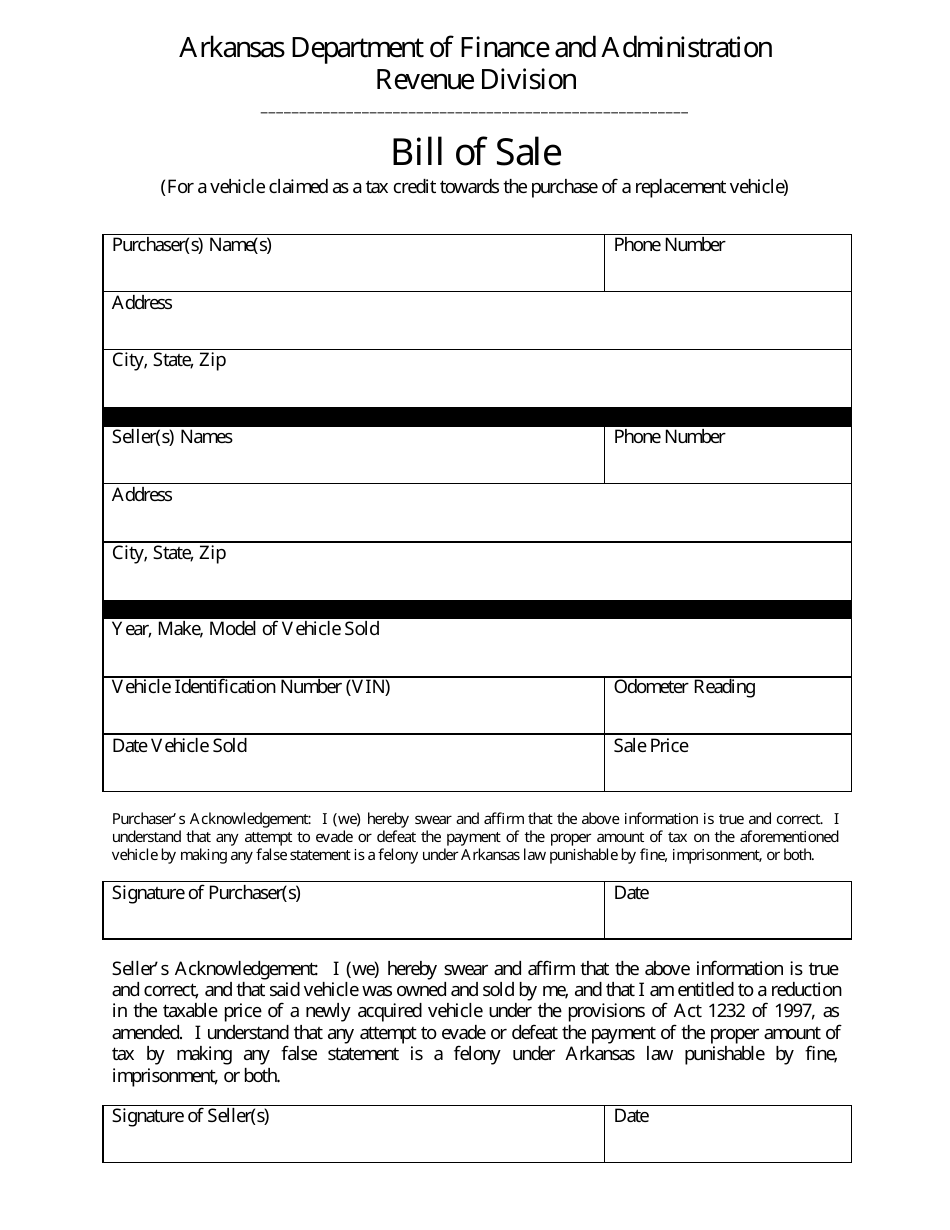

Act 1232 of 1997 as amended by Act 277 of 2021 provides for a sales and use tax credit for new and used motor vehicles trailers or semitrailers purchased on or after July 28 2021 if within 60 days either before or after the date of purchase the consumer. The law provides for a sales and use tax credit for new and used motor vehicles trailers or semi trailers purchased on or after January 1 1998 if within 45 days either before or after the date of purchase the consumer sells a used motor vehicle trailer or. There are a total of 268 local tax jurisdictions across the state collecting an average local tax of 2126.

Arkansas collects a 65 state sales tax rate on the purchase of all vehicles which cost more than 4000 dollars. SB576 also would phase in a reduction in the top corporate income-tax. Click here for a larger sales tax map or here for a sales tax table.

Office Address PhoneFax. February 25 2020. Texarkana residents must pay 7 percent.

File by mail You can use Form ET-1 and file and pay through the mail. Option 1 - ACH Debit Payments - Arkansas Taxpayer Access Point ATAP New users sign up at wwwataparkansasgov or click on the ATAP link on our web site wwwdfaarkansasgov. Tax is computed on the total delivery price including rebate freight charges and extra equipment.

Sales Tax Credit for Sale of a Used Vehicle. Home Excise Tax Sales and Use Tax Remote Sellers. 2014 creates an entity-specific sales tax credit for the sale of a used motor vehicle in lieu of a tradein.

Ledbetter Building 1816 W 7th Ste 2340 Little Rock AR 72201. Remote Seller Beginning July 1 2019 the Arkansas Legislature will enact Act 822 of the 92nd Legislative Session which requires that on-line and other remote out-of-state sellers collect state and local sales and use taxes in those states where the seller does not have a physical presence but where they sell and deliver their.

Sales Tax Info For Online Sellers Kansas Missouri United States The Unit

Resultado De Imagenes De Google Para Https Www Factorywarrantylist Com Uploads 3 3 9 4 339465 Bill Of Sale Template Business Card Template Word Bill Template

Sales Tax Exemption Increase On Used Cars Proposed

Car Tax By State Usa Manual Car Sales Tax Calculator

Grown How To Get A Vehicle Assessed Registered In Arkansas

Arkansas Sales Tax Small Business Guide Truic

Ar 10 381 2019 2021 Fill Out Tax Template Online Us Legal Forms

How To Get A Sales Tax Exemption Certificate In Arkansas Startingyourbusiness Com

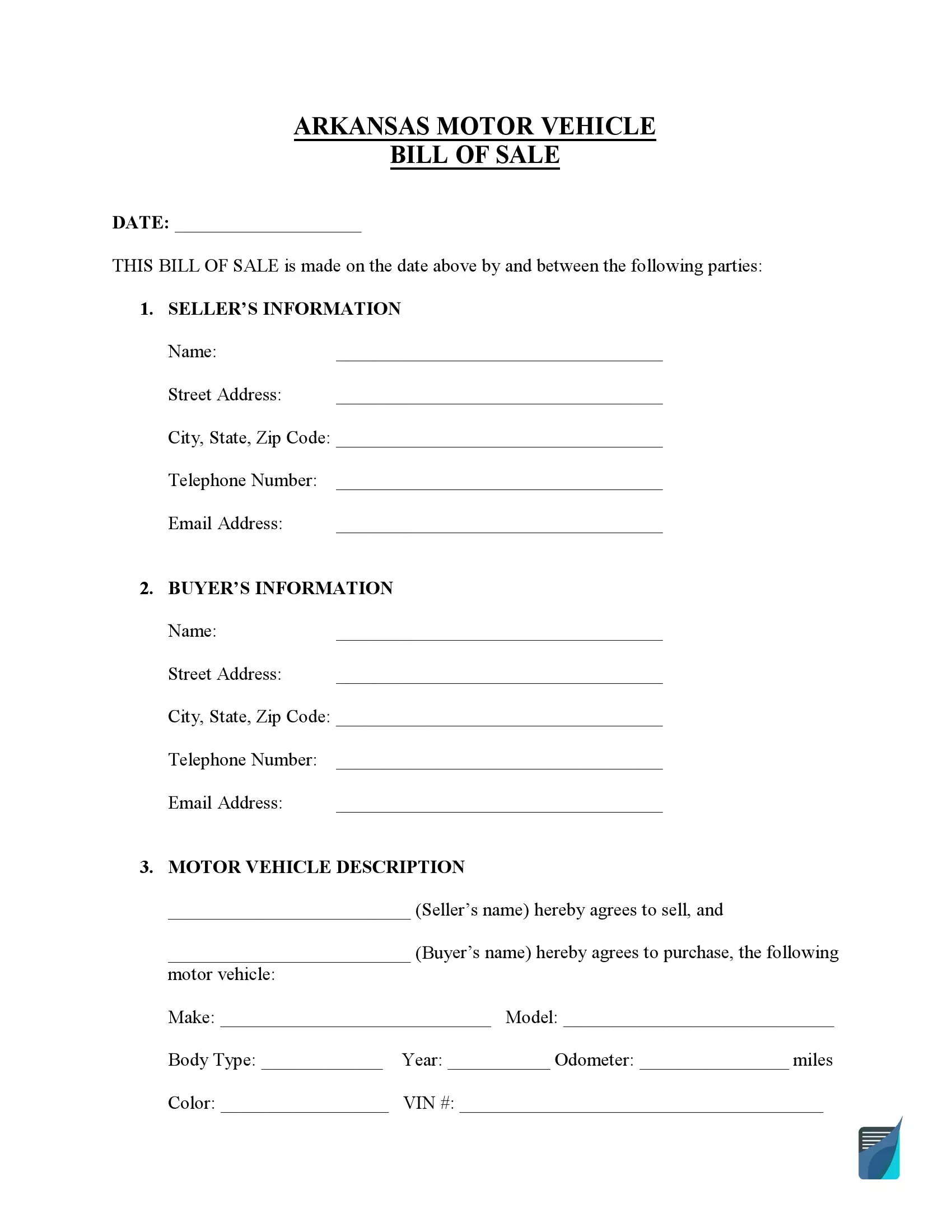

Free Arkansas Bill Of Sale Form Pdf Template Legaltemplates

Free Arkansas Vehicle Bill Of Sale Form Pdf Formspal

2015 Sales Tax Holidays By State Tax Holiday Holiday News State Holidays

Arkansas Vehicle Bill Of Sale Credit For Vehicle Sold Download Printable Pdf Templateroller

Free Arkansas Tax Credit For Replacement Vehicle Bill Of Sale Pdf Eforms

Get Help Today Click The Image Tax Day Tax Free Internet Shop

Sales Tax On Cars And Vehicles In Arkansas

The Madman Video En 2020 Drole

Mazda Mazda3 Dealer Near Franklin New Mazda Mazda3 For Sale At Our Mazda Mazda3 Dealership In Franklin Car Dealership Mazda Mazda3 Mazda

Posting Komentar untuk "Arkansas Car Sales Tax Online"